27+ Las Vegas Paycheck Calculator

Only need to pay federal income. Processing payroll in Nevada doesnt have to be difficult.

Nevada Hourly Paycheck Calculator Gusto

Thats where our paycheck calculator comes in.

. Demands for a living wage that is fair to workers. The taxable wage base is equal to 66 ⅔ percent of the Nevada average annual wage for employees. Nevada Salary Paycheck Calculator.

Calculate your Nevada net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nevada. To calculate the amount of sales tax to charge in Las Vegas use this simple formula. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Nevada Hourly Paycheck Calculator. No standard deductions and exemptions. The average calculator salary in North Las Vegas Nevada is 40833 or an equivalent hourly rate of 20.

This free easy to use payroll calculator will calculate your take home pay. The average calculator gross salary in Las Vegas Nevada is 40755 or an equivalent hourly rate of 20. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Supports hourly salary income and multiple pay frequencies. Sales tax total amount of sale x sales tax rate in this case 838. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. The median household income is 58003 2017.

Salary estimates based on salary survey data collected directly from employers. With the information you need to correctly calculate employees paychecks and your payroll. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. How to calculate annual income. This is 5 higher 1775 than the average calculator salary.

As an employer you have to pay the states unemployment insurance. For example if an employee earns. And for 2022 the first 36600 of.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. For 2023 Nevadas unemployment insurance rates range from 03 to 540 with a taxable wage base. Important note on the salary paycheck calculator.

It can also be used to help fill steps 3 and 4 of a W-4 form. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Or to make things even easier input.

Nevada calculates the unemployment tax each year. The federal minimum wage is 725 per hour while Nevadas state law sets the minimum wage rate at 105 per hour in 2023.

Final Program Asprs

Top 5 Battery Powered Outlets Aka Portable Power Stations Shopsolarkits Com

Is There Any Difference Between The Black And Red Sides Of A Table Tennis Paddle Quora

10 Best Realtors In Texas 2023 Rankings Houzeo Blog

Accidental Tech Podcast Toppodcast Com

Nevada Hourly Paycheck Calculator Gusto

Dolphins Vs Chargers Odds Picks Predictions Week 14 Will Tua And Herbert Lead A Shootout

Nevada Paycheck Calculator Smartasset

13 Best Property Management Companies In Orlando Fl 2023

.png?width=350)

15618 W Ripple Rd Goodyear Az Usa Apartments 15618 W Ripple Rd Goodyear Az Rentcafe

Paycheck Calculator Take Home Pay Calculator

Nevada Paycheck Calculator 2022 2023

Free Slots Live Dealer And Table Games At Sugarhouse Casino4fun

Pdf Howard Rumsey S Lighthouse All Stars Modern Jazz In California 1948 1959 Pdf Robert Hughes Academia Edu

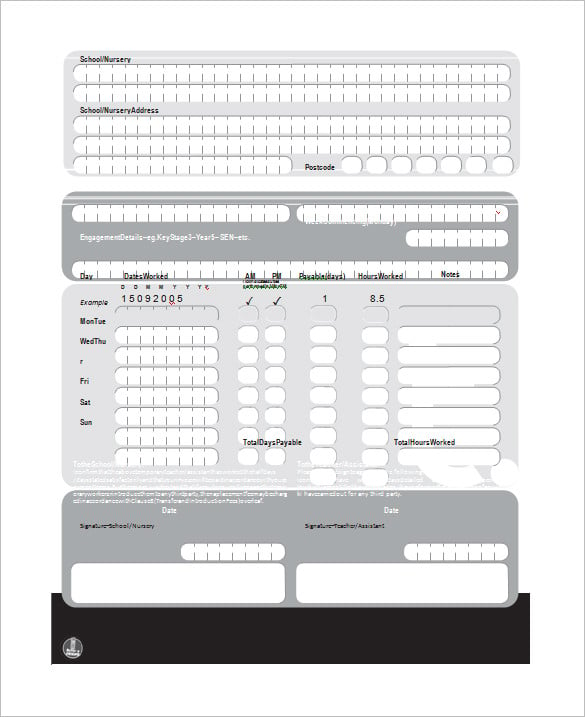

8 Salary Paycheck Calculator Doc Excel Pdf

:fill(white,1)/files.directliquidation.com/directliquidation/2019/09/00f5dc40ad51d39afb99a71ec5625c5d-picture.aspx_.jpeg)

Pallet 44 Pcs Diapers Wipes Customer Returns Luvs Huggies Pampers Sweet Potatoes

Ebook Their Stories With The Debut Album Pdf Albums Singing